$12M capped 4CE to Acquire Lithium Ground 30km from $130M AVZ

Published 10-AUG-2017 09:46 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Small Cap presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high-risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Today’s ASX junior has its gaze set on the Democratic Republic of Congo’s lithium reserves.

Just this week Force Commodities Limited (ASX:4CE) executed a binding Heads of Agreement (HOA) to acquire majority interests in two lithium projects in the DRC.

Both are considered highly prospective for lithium, as well as tin and tantalum.

The deal includes one mining licence and one exploration license, extending over 500 square kilometres in an area known to have the largest and highest grade pegmatites in the world.

4CE look to be following a similar path to AVZ Minerals’ (ASX:AVZ). And that’s not a bad thing.

Just last year, AVZ acquired a high grade lithium asset in DRC that has proved to be an exceptional strategic decision. AVZ reported high grade lithium in its initial exploration and drilling program at its DRC ‘world-class’ project.

Did we mention that AVZ’s tenements are each located 50 kilometres or less from that of 4CE, in an extensive historical mining region where extensive lithium mineralisation has been confirmed.

AVZ has had an exceptional run since its ‘bigger than Greenbushes’ acquisition, with significant rallies coming on news of DRC lithium asset acquisitions.

While it’s still early days, investors are starting to take notice of 4CE. And it has every reason to catch their attention, with recent news of its DRC lithium asset acquisitions looking very familiar to what AVZ did before it.

However, before we go too far, it should be noted that for political and social reasons, this is a very high-risk stock. Running mining projects in countries such as the DRC is no simple feat, and there may be challenges ahead.

In line with the HOA, the company will acquire a 70% interest in each of the two projects, spanning an area of 500 square kilometres. These licenses are located at the Manono pegmatite field and are just 30 kilometres southwest and 50 kilometres east of AVZ Minerals’ Manono Project.

It also has the option to secure additional exploration licenses in a joint venture with the DRC state mining company.

With global lithium resources estimated to be 39 metric tonnes with a major supply shortfall forecast, it seems 4CE has transitioned to lithium at just the right time.

This small cap explorer has been valued by the market at just $7 million, compared to nearby AVZ and its $130 million market cap.

Yet the nearology of this company’s tenements alone are reason to anticipate a significant rerating when investors start to catch on.

Could 4CE emerge as a force to be reckoned with?

Introducing...

Force Commodities Ltd (ASX: 4CE) is an exploration company that is not afraid of adaptation.

Following a management shakeup and the appointment of a new company Chairman in David Sanders, along with new Director, Jason Brewer, the company has aligned its exploration pursuits with the heightened demand for new energy metals, namely cobalt and lithium.

4CE completed a capital raising in July 2017, securing $805,000 to support its search for new project opportunities.

It is a savvy move...

The location, the commodity, and the expertise

The project location, the rising demand for lithium and the expertise of 4CE and its management team plus in-country exploration expertise all come together as a highly attractive proposition for small cap new energy investors.

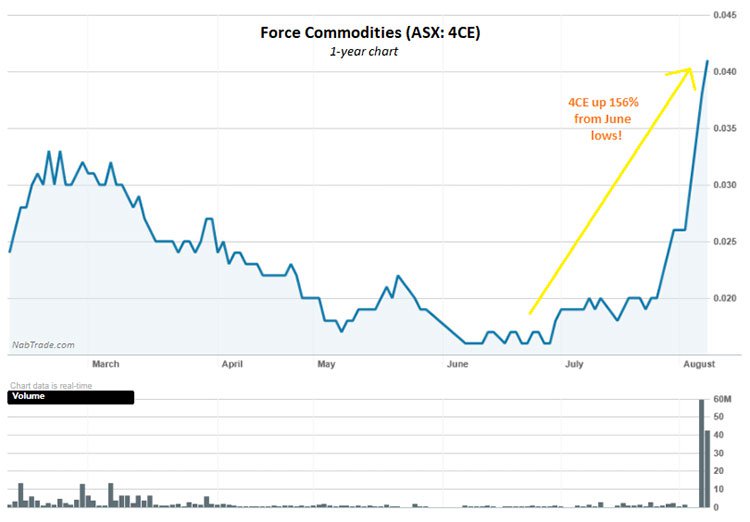

Investors are already impressed by the company’s new direction.

Since its June lows of just 1.6 cents, early investors have caused the share price to rally by more than 150% on significant volume.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Don’t kick yourself if you didn’t back 4CE in June or July. If the performance of nearby AVZ is anything to go by — and there’s good reason to believe that it is — then 4CE has plenty of room left to run.

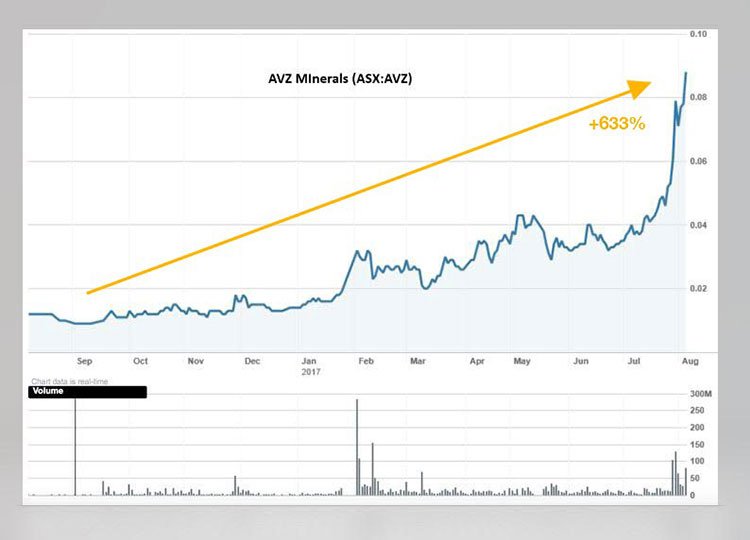

As you can see in the chart below, AVZ is up a massive 633% over the past 12 months.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The strong recent share price performance of both 4CE and AVZ highlight that fact that investors are betting on DRC lithium and the inherent potential in the two companies tenements.

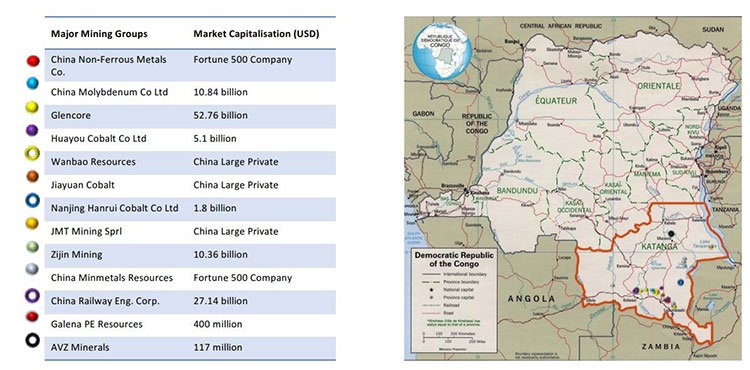

The following table tells a story in itself. Here’s a look at the market caps of the players in and around this region. It makes for impressive reading.

4CE is looking to make the list, so what is the back story here?

Well, under the guidance of a new management team, 4CE embarked upon an intentional global search to identify advanced, near-term production project opportunities. And now, as announced just this week...

4CE has its hands on two highly prospective DRC lithium projects...

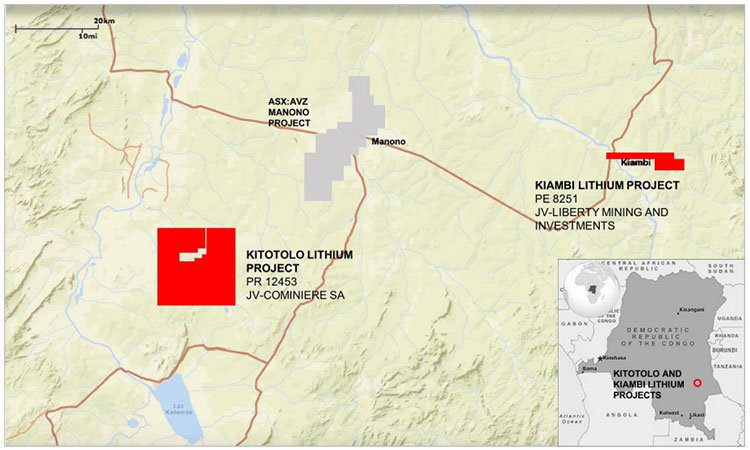

4CE has executed a Heads of Agreement (HOA) to acquire majority interests in the Kitotolo and Kiambi Lithium Projects. The two projects are located in Tanganyika Province in the south east of the Democratic Republic of Congo (DRC).

4CE’s projects lay within the highly prospective mid-Proterozoic Kibaran Belt — an intracratonic domain, stretching for over 1,000 kilometres through Katanga and into southwest Uganda representing a world scale crustal feature. You can read more about this in our sister publication finfeed.com :

Acquisition Terms and Structure :

4CE has executed a HOA with Lithium Age Pty Ltd (LAPL), to secure the exclusive rights to acquire LAPL’s rights to the Kitotolo Lithium Project and the Kiambi Lithium Project.

Under the terms of the HOA, 4CE has the rights to acquire:

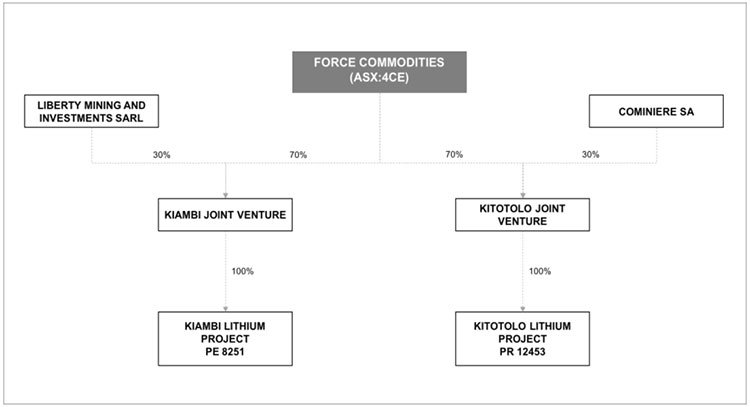

- A 70% interest in the Kitotolo Lithium Project under a new joint venture to be formed with the DRC state-owned entity Cominiere SA. Further Exploration Licences are to be granted to the joint venture by its partner subject to certain exploration expenditures being met.

- A 70% interest in the Kiambi Lithium Project under a new joint venture to be formed with DRC private company Liberty Mining and Investments SARL.

Here you can see the acquisition structure of the Kiambi and Kitotolo Lithium Projects:

Further details of the agreement are set out in the company announcement below:

In summary, 4CE signed a binding HOA to acquire a 70% interest in the two projects, the Kitotolo Lithium Project and the Kiambi Lithium Project, subject to legal and technical due diligence (that is now underway) being met.

As this HOA is still in its early stages, investors should seek professional financial advice for further information if considering this stock for their portfolio.

Now let’s have a look at the projects in more detail.

The Kitotolo Lithium Project

The Kitotolo Lithium Project comprises exploration licence (PR 12453), which is in renewal process, covering an area of 400 square kilometres.

It is to be explored in joint venture along with DRC state-owned mining company La Congolaise d’Exploitation Miniere (Cominiere SA).

The project is located approximately 30 kilometres southwest of AVZ Minerals Limited’s Manono Project (ASX: AVZ) and overlays a large portion of the ‘world-class’ Manono-Kitotolo Pegmatite.

The Manono deposit has produced approx. 140,000t of tin concentrate and 4,500t of columbite-tantalite concentrate.

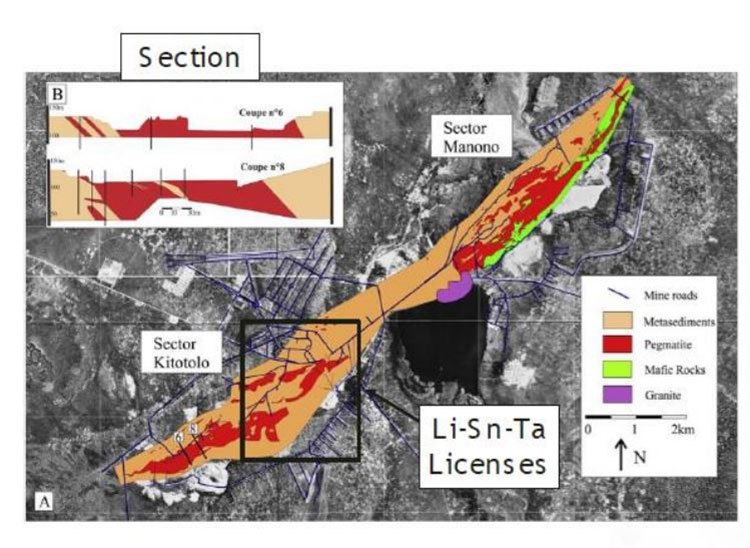

Here’s a look at the geology:

The Manono-Kitotolo Pegmatite is considered one of the world’s largest mineralised rare metal pegmatites, with a large potential for lithium as spodumene, cassiterite and columbite–tantalite (coltan). It has been identified to be the largest pegmatitic deposit of spodumene, cassiterite and columbite–tantalite ever mined.

Limited historical reporting states that the pegmatites in the region are hosted by a series of quartz mica schists of the Lower Kibaran and are associated with volcanic and intrusive rocks of mainly doleritic composition.

The schists observed in the vicinity of the Manono Mine are generally steeply dipping in contrast to the sub-horizontal altitude of the pegmatite intrusion.

The pegmatite intrusion is exposed in two areas, Manono in the northeast, and Kitotolo in the southwest. These are separated by a 2.5 kilometre unexposed section centred on Lake Lukushi and the surrounding alluvial plain.

Recent trenching and drilling results reported by AVZ has confirmed the presence of high grade lithium mineralisation along strike for more than 13 kilometres, and demonstrates the potential for 4CE’s yet to be drill tested Kitotolo Lithium Project.

The Kiambi Lithium Project

Just 80 kilometres up the road from the Kitotolo Lithium Project is the Kiambi Lithium Project. The project is 600 kilometres north of Lubumbashi, the capital city of the Katanga Province, in the locality of Kiambi.

It is well located logistically too, just 20 kilometres from the Mpiana Mwanga hydro electrical power plant and near to access roads.

The project comprises granted Mining Licence (PE 8251), which covers an area of 34 square kilometres and is valid for 30 years from April 2015 and can be renewed for 15 years at a time. This allows for the potential fast-tracking of any initial small scale mining activities required to provide bulk samples to potential offtake and end users.

The project is to be explored in joint venture with private Congolese company Liberty Mining and Investments SARL (Liberty).

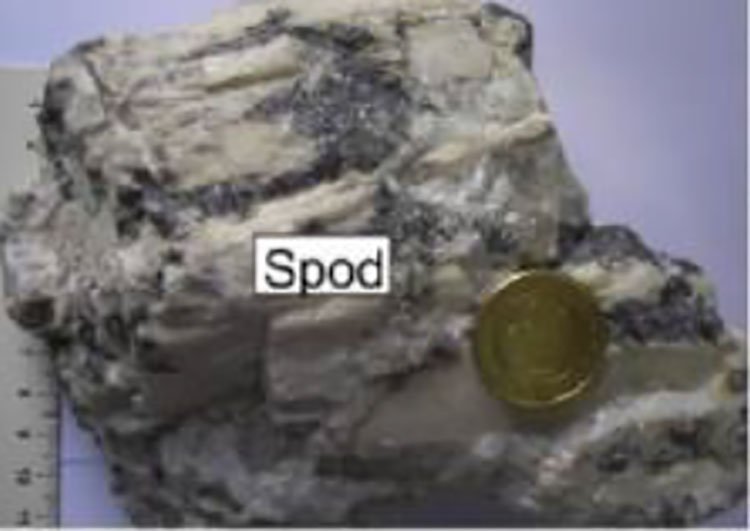

Outcrops of pegmatites have been reported at Kiambi, however no testing of the lithium content of the spodumene has been undertaken given the focus to date has been on the mining and sale of cassiterite and columbite–tantalite.

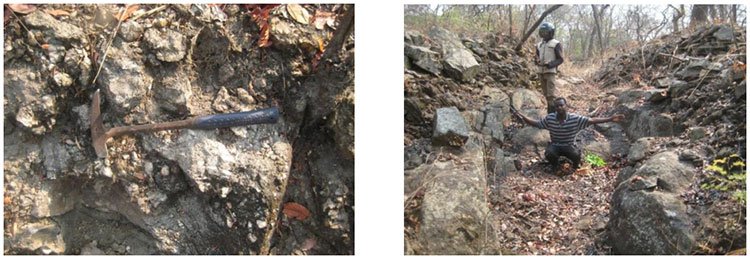

Here are some images of outcropping pegmatites at the Kiambi Lithium Project (PE 8251):

The project area was mined historically for cassiterite by the Belgians, with mining reported to have ceased in 1953. Although small scale mining has continued through to today.

Historical studies and reports identified the presence of pegmatites in the project area, which are considered highly prospective for the potential of lithium, cassiterite, tantalite, gold, and wolframite mineralisation.

Here you can see outcropping pegmatites and historical trenching at the Kiambi Project:

There are numerous artisanal mining operations active within the project area, primarily focused on extraction of cassiterite and columbite–tantalite. A large number of artisanal mining activities have also been observed on the adjacent licenses at Kiato, Kifinga and Mwika.

A major point to note is that the project is just 30 southwest and 50 kilometres east from AVZ Minerals’ Manono Project.

Exceptional nearlology

4CE’s Kiambi and the Kitotolo Lithium Projects are located on the world’s largest and highest grade pegmatite field.

The lithium pegmatite deposits in the Manono-Kitotolo region consist of two main zones of pegmatite, having a strike length of greater than 15 kilometres and an average width of 800 metres.

The lithium mainly occurs as spodumene, and significant high-grade lithium of 1-4% has been identified. Spodumene potential was only first evaluated during the 1980s and estimated at 330,000t of contained lithium, making it the 4th largest lithium pegmatite intrusion in the world.

This is the same field that is home to AVZ’s recent high-grade lithium asset acquisitions. AVZ is completing its first really lithium-focused exploration on the ground, and in just months has managed to define a world class project with high-grade lithium reported from initial exploration and drilling.

AVZ’s project has been confirmed as being twice the size of Australia’s largest lithium mine — Talison Lithium’s Greenbushes Mine in Western Australia.

That is clear validation of the huge lithium resource potential in the DRC.

You can see both of 4CE’s DRC projects on the map of DRC below, along with AVZ’s Manono Project.

Due diligence on track for completion with initial technical work planned

It’s worth noting that the HOA does remain subject to legal and technical due diligence being finalised and regulatory and shareholder approvals.

During the exclusive due diligence period 4CE plans to complete a geological mapping and sampling program at both projects to confirm the presence of lithium, tin and tantalum mineralisation.

The company is in the process of engaging a technical consultant to complete the due diligence work on its behalf , one who has appropriate in country experience in the due diligence studies and drilling programs across the Manono-Kitotolo Pegmatite.

Following completion of this technical due diligence initial work, and on the assumption that it is favourable, 4CE would propose to aggressively advance further trenching and drilling programs across both project areas to identify the extent of the mineralisation and its commercial viability through metallurgical test-work.

4CE intends to progress the projects through to project feasibilities as soon as possible after due diligence is complete.

The final word

It seems that 4CE is on track to legitimise/prove its decision to focus on lithium exploration and mining opportunity in this highly prospective rare metal pegmatite with by-product tin and coltan.

However, 4CE does remain a speculative stock and investors should take a cautious approach to their investment decision in this stock and seek professional financial advice.

The company has secured a large landholding of 500 square kilometres with the possibility to add more exploration licences in time.

All this in an area near to where AVZ has just reported high-grade lithium from its initial exploration and drilling program.

This high-grade lithium from AVZ’s nearby projects along with the fact that Artisans are already exploiting lithium from the company’s tenements lend the investment case for 4CE some major support.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.