$1.6BN Major Farms into Fraser Range Nickel Province

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

MMG Limited is one of the world’s leading diversified base metals companies, and commands a market cap of over a billion dollars.

This cashed up major casts its net far and wide, hunting down the most prospective regions across the globe for the next big mineral discovery.

Its highly experienced team of geologists recently honed in on the Fraser Range and the hive of nickel exploration activity underway there.

One company and 2,250 km 2 of its exploration ground stood out from the rest in the Fraser Range – and that company is Segue Resources (ASX:SEG).

MMG was so impressed by the quality of exploration conducted to date, and the potential for a near term nickel discovery, that it is committing up to $14M of exploration funds in a JV with SEG.

To cut a long story short, SEG is keen to emulate $1.1BN-capped Sirius Resources (ASX:SIR), who went from securing several Fraser Range tenements in 2009 to a billion dollar market cap in just over 3 years – all down to a large, valuable, game changing nickel discovery.

There was definitely an element of luck involved for Sirius – such is the world of minerals exploration. Whilst SEG is hoping to emulate Sirius, there is no guarantee SEG will find commercial quantities of nickel.

We have been following SEG for two years now as it goes about defining what is beneath its ground, and with a cashed up major now backing it, the company appears to be in a much stronger position to make a nickel discovery than ever before.

However it’s trading at much lower levels than previously...

Once the nickel price recovers, and SEG’s exploration programme kicks into a higher gear with MMG, we would imagine this company to be on a lot more people’s radars...

We have covered Segue Resources (ASX:SEG) in some detail over the past 2 years, as the junior steadily explored one of the Fraser Range’s largest tenement packages, covering over 3,300 km 2 .

Our first article, ‘ Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets ’ introduced SEG and went into detail about its nickel exploration activities in the Fraser Range.

Two years on from our initial coverage, SEG has completed a whole heap of exploration work including aeromagnetic & gravity surveys, 3D mapping and soil geochemistry analysis spread across its primary project, and is edging closer to making that all important nickel discovery.

SEG has also secured the very first farm-in joint venture in the Fraser Range Province with a major global resources company. The tie-up with MMG secures funding for future exploration and brings in top notch expertise to hasten and improve current exploration activities.

The multi-year, multi-million dollar farm-in with MMG maximises the potential for a significant, commercially-sized nickel discovery in the foreseeable future

As part of the deal, MMG will provide SEG’s projects with a highly skilled team of geologists and geophysicists, who will undertake a large and accelerated nickel exploration programme over several years...

But not only that...

MMG has agreed to spend $14M in exchange for a potential 70% stake in 8 tenements from within SEG’s portfolio.

The deal means SEG has its exploration funding essentially secured, and will only have to give up a proportion of its overall resource if one is found and defined.

30% of a potential billion dollar discovery is more attractive than 100% of nothing...

The additional exploration funds are likely to help SEG hasten its exploration activity in the near term, guided and directed by MMG’s highly credentialed exploration team.

And given MMG’s experience and market position, it would be in a good position to assist considering its credentials and active development projects currently in the pipeline.

Here is a snapshot of some of their current mining endeavours – there is nothing small about these projects:

MMG’s Project List

Judging by Comparison

If one thing is for sure, it’s that nickel discoveries take a lot of effort and exploration dollars.

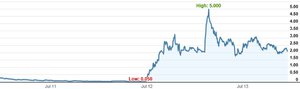

Sirius went through a long path to discovery in 2009-2012 and just look at what happened to its share price once the nickel discovery was made in July 2012:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

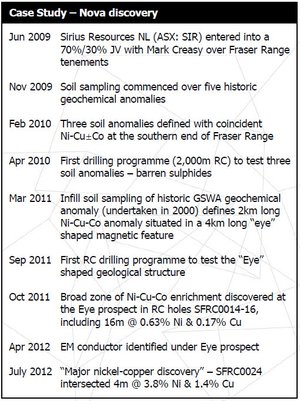

Here is a rough summary of the timeline between 2009 and 2012 which preceded the sharp appreciation in its share price:

Timeline of SIR’s Rise to Prominence, source: Segue Resources

As you can see, Sirius spent several years in exploration before its elevation higher on the back of a significant nickel discovery that had large commercial potential.

SEG is now attempting to walk a similar path, but backed by a strategic $14M JV agreement that funds further exploration in return for stakes in SEG’s projects.

This incremental, risk-mitigated strategy is designed to emulate Sirius’ successful nickel discovery...

...and why SEG has come back onto our radar.

The parallels between Sirius and SEG don’t stop there...

Sirius was a very small company before it made its nickel discovery.

And, SEG is also relatively undervalued judging by its tenement package versus its market capitalisation compared to its Fraser Range peers:

Chart comparing Fraser Range tenement sizes and ASX Market caps

Despite owning the third largest tenement package in the Fraser Range, SEG’s market valuation is somewhat lagging.

This creates the opportunity of a share price convergence as SEG is considered relatively undervalued to other comparable nickel explorers, capped at around just $6.5M.

Ideally SEG needs to hit a significant strike of nickel in their next drill campaign – which would see a rise almost overnight of SEG’s market cap. However there is no guarantee of success here – caution should be taken when considering an investment in SEG.

Our Track Record

Did you see our Next Tech Stock article New ASX Tech Company has the Answer? on Crowd Mobile (ASX:CM8)? Since that article was released, CM8 has been up as high as 85%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

In addition to the JV news, SEG is seeing positive results from exploration and fieldwork done so far

Here is a summary of SEG’s current projects and results seen so far...

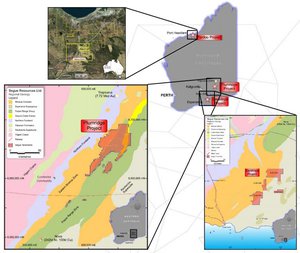

Map showing all SEG Projects in Western Australia

Plumridge Project – Fraser Range

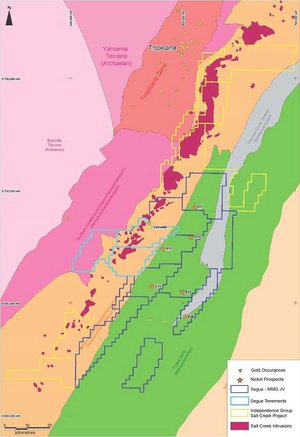

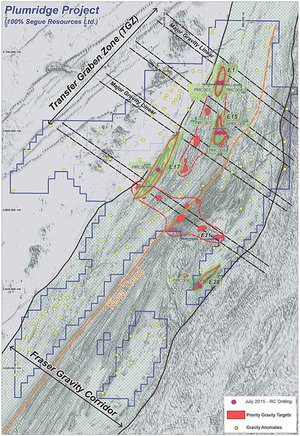

Mapped out below is SEG’s Plumridge Project showing SEG’s tenements in Blue, MMG’s 8 farm-out tenements we mentioned earlier in dark blue, and Independence Group NL (ASX: IGO)’s tenements in Yellow.

Source: Segue Resources

The Plumridge project is SEG’s most prospective for a large nickel sulphide deposit

SEG’s gravity survey suggests there are 15 high priority targets that warrant immediate exploration...

And SEG has been quick to get the job done by putting in drill holes, taking samples and now awaiting results.

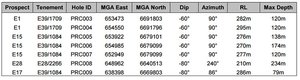

RC drilling of the first high priority targets has commenced with 1,000m already done with assay results due to be completed in the coming weeks.

Table detailing SEG’s most recent RC drill holes

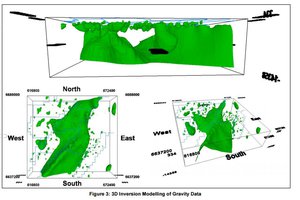

Meanwhile, sophisticated 3D imaging has clarified a lot for SEG’s geologists and their work is now relatively easier given the strong initial results and mapping (shown below):

Mapped out below is the latest state of play for SEG.

As you can see, there are over one hundred ‘gravity anomalies’ (shown as yellow dots) which SEG has now whittled down to 15 prospective targets currently being drilled (shaded red). The 7 most recent drill holes are shown as purple dots.

Original image source: Segue Resources

One of the most compelling aspects to the data for SEG is that data from its northern targets indicates potential nickel-hosting intrusive bodies are at an average depth of around 80m which is reasonably shallow and therefore easy to reach.

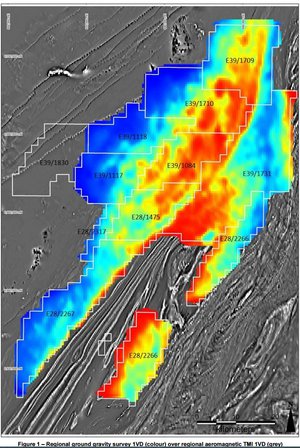

Gravitating Towards a Nickel Sulphide Discovery?

SEG’s most substantial (and lengthy) piece of exploration has been its gravity survey, completed at Plumridge over the past year, with work that extended to include aeromagnetic & gravity surveys, 3D mapping and soil geochemistry analysis.

SEG geologists conducted detailed surveys of the geology below the surface from 19,406 stations, covering an area of 3,000km 2 . This significantly enhanced SEG’s understanding of Plumridge’s “tectonic architecture”...

...which in layman’s terms means SEG obtained a much better visual understanding of what it has locked away below the ground at its Plumridge Project.

As a consequence, SEG was able to identify 15 high priority targets that may well feature mineralisation, including close to surface “gravity anomalies” that put substantial nickel sulphide deposits within easy reach for SEG.

The Plumridge ground related to the JV with MMG is all the focus right now, especially given the amount of cash backing behind exploration here.

But SEG also have a few other projects cooking away in the background, so let’s take a closer look at those.

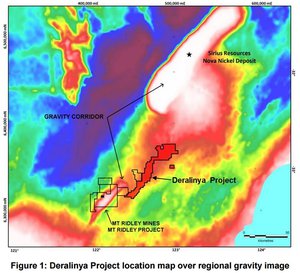

Deralinya Project – Fraser Range

With licenses covering an approximately 760 km 2 , this project is SEG’s second priority after Plumridge. The project is located 120km from SIR’s mammoth Nova-Bollinger deposits and is adjacent to Mount Ridley’s (ASX:MRD) nickel project.

SEG recently announced a lead-in JV agreement with Omni GeoX – a geology specialist who SEG was using for its own geological assessments. Under the terms of the venture, Omni can ‘earn-in’ up to a 30% stake in the Deralinya Project if it carries out at least $130,000 of exploration expenditure.

Moving forward, SEG will still continue exploration at Deralinya but will share the cost of doing so via a 70/30 split with Omni.

This type of farm-in agreement is an excellent method of advancing high-value projects as it shares the costs (and risks) of conducting pricey exploration and fieldwork.

In tough economic times, there are still plenty of opportunities – it’s just a question of how independent you can afford to be.

As part of its agreed farm-in expenditure, Omni has already initiated a soil sampling program that has so far generated 308 drill samples. The samples were sent away for detailed analysis in early August and the results are pending.

But judging by its magnetic imagery, SEG seems to be lurking in the right spot for a significant nickel sulphide deposit.

Omni’s geophysics work has led to the identification of 6 target areas , most likely to contain high grade mineralisation below the surface.

Keeping up with the Joneses

One omen SEG is likely to be mindful of is the recent increase in exploration activity by neighbouring explorers such as Mt. Ridley (ASX:MRD), Buxton Resources (ASX:BUX) and Pioneer Resources (ASX:PIO).

And just recently, Independence Group NL (ASX: IGO) entered into the Salt Creek joint-venture with AngloGold Ashanti covering close to 3,000km 2 of tenements to the north and south of SEG’s Plumridge project.

IGO has undertaken a detailed gravity survey and air core drilling which has identified areas of anomalous Ni and Cu geochemistry.

With Fraser Range exploration continuing unabated, it confirms SEG are in the right region for high potential minerals exploration.

The recent flurry of activity suggests that all the budding explorers in the region are aware of the same thing – there is significant potential for more nickel resources to be discovered in the Fraser Range.

Pardoo Project – Pilbara Region

In a similar vein to Plumridge and Deralinya, SEG will utilise a farm-in model at its third project – Pardoo.

In April this year, SEG signed a Binding Term sheet to farm out its Pardoo project to Port Exploration Pty Ltd (Port) in exchange for $50,000 and subject to Port becoming a subsidiary of an ASX-listed entity. As part of the agreement, Port can earn-in up to 51% of the Pardoo project by spending $250,000 on exploration within the next 12 months...

...and a further 29% (to bring its total stake up to 80%), if it spends a further $250,000.

The deal effectively allows SEG to maintain exposure to highly prospective tenements without spending more exploration dollars on the Pardoo Project.

Its hopes and ambitions are first and foremost at Plumridge and therefore, most of its future exploration is targeted there.

To finalise exploration activities, SEG has secured $2.5M in funding...

Backed the JV deal with MMG, which will see MMG contribute the lion’s share of the necessary funding in exchange for an earn-in of the ground, SEG will also need to complement funding, and to this end, SEG has secured funding from three different sources:

- Existing shareholders were offered the opportunity to tap SEG’s Share Purchase Plan (SPP) and they responded by subscribing to an additional $928,000 last month...

- This was added to with a private placement totalling $500,000

- And finished off by its active Controlled Placement Agreement (CPA) with Acuity Capital which guarantees SEG at least $1M in funding if and when it needs additional capital.

In total, SEG has secured $2.5M in funding, designated for one thing only...

...exploration to hopefully define the largest and highest quality nickel sulphide resource possible.

Which would be great for SEG shareholders, however there are no certainties here – SEG is a small cap, speculative investment.

He Who Dares Wins

SEG has completed several transactions over the past 2 years to achieve 100% ownership of over 3,300km 2 of tenements in Western Australia – with no 3rd party royalties or deferred payments anywhere in sight.

The company has also been able to define its targets to the point where it’s been able to attract the first mining major JV deal in the Fraser Range.

This is a significant milestone because after doing the hard yards of exploration for several years, SEG may now be on the final straight to a discovery.

After SEG processes all its fieldwork results in tandem with resource-experts MMG, the explorer is likely to be in a position to complete additional drilling and with it hopefully a substantial discovery.

That’s the time when SEG shareholders are likely to really be rewarded – and it could happen very quickly over the coming months...

But this is a speculative investment – there is simply no guarantees in the world of nickel exploration by small companies – SEG may find nothing at all.

In any case, here at The Next Small Cap, we’ll be keeping a close eye on how it all plays out for SEG, keeping our readers abreast of developments.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.